Recent UK-China Talks are a Boost to Tourism and Aviation Ties, but the UK is Still Playing Catch-Up12/24/2017

The past two weeks have been very good for UK-China relations, economically, politically and tourism wise as well. There has been much talking and dialogue been done over the years but not much execution of any concrete actions when it comes to increasing tourism and economic ties between the two nations. So, it was particularly nice to see a number of trade agreements being made when Chinese Premier Li Keqiang met with the British Chancellor of the Exchequer Philip Hammond, carrying on their pledge to strengthen political trust and cooperate in a number of key areas, such as trade and investment.

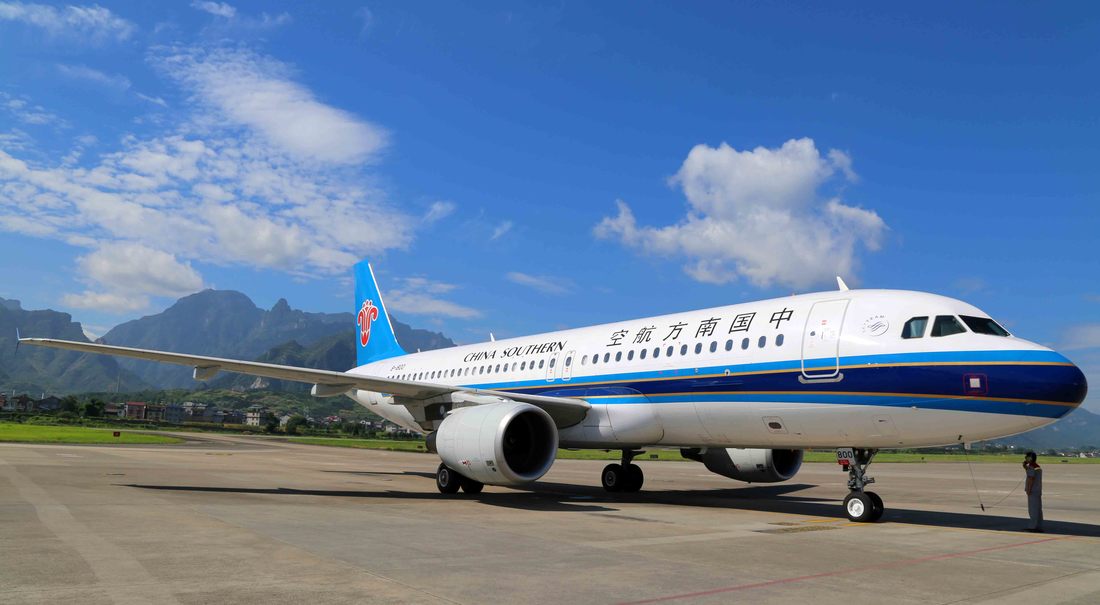

“This year marks the 45th anniversary of the establishment of diplomatic relations at the ambassadorial level between China and Britain,” Premier Li said, noting that bilateral ties would develop on the basis of mutual respect and equality. He said Britain was a highly open economy, and China would advance its opening up. In particular this followed on from earlier in the week when the United Kingdom and China agreed to increase their weekly flight quotas with a 50% increase in the limit of weekly flights between the countries. The current bilateral agreement from 2016 sets the limit at 100 flights per week, while under the terms of the new deal the limit will be raised to 150. According to the timetables I have seen on OAG Aviation, there are currently 59 weekly non-stop flights between China and the UK. FlightGlobal schedules data shows that Air China accounts for the highest seat capacity between the UK and China (30.2%), followed by British Airways (20.6%) and China Southern Airlines (12.5%). China Eastern Airlines are also leading when it comes to the total traffic between Europe and China with 130 flights per week and a strong 24.3% market share by capacity, although those numbers also include non-EU countries. There are also non-stop flights to second-tier cities including Tianjin, Qingdao and Chongqing. Those in the aviation industry would have been waiting for this moment for years, and even though it is not too late for the UK to start operating more flights to mainland China, I do feel that the UK is playing catch-up with the rest of the EU and the world for that matter when it comes to competing for landing slots in destinations in the UK-China space. If you look at some of the second-tier Chinese cities, they already have well-established non-stop routes to some European and Middle Eastern cities with other major carriers. Air China, China Southern Airlines and Lufthansa are the biggest players on the Europe-China sector and this is reflected in the Star Alliance controlling almost half of the seats on these routes and Sky Team’s Air France and KLM both have strong positions in Amsterdam and Paris respectively. You can get non-stop flights to Amsterdam with KLM from Hangzhou and Xiamen and from Wuhan and Guangzhou to Paris with Air France. Turkish Airlines, voted by Skytrax World Airline Awards “Europe’s Best Airline” award for six consecutive years until 2016, and the “Southern Europe’s Best Airline” award for the ninth time in as many years, flies to all the major Chinese cities from Istanbul. We also have the three Middle Eastern giants - Emirates, Emirates and Qatar Airways - operating numerous non-stop schedules to all the major Chinese cities for a number of years already and even to some destinations in China that most British and European people may have never heard of, such as Yinchuan and Zhengzhou which Emirates flies to. By contrast, British Airways and Virgin Atlantic find themselves in the most competitive Europe-China market and without a Chinese partner at the moment. Why doesn’t British Airways fly to Guangzhou or Chongqing or even Hangzhou? Hopefully, with the open skies agreement, things will change (but don’t hold your breath!). China has the world’s second largest passenger aviation market with enormous growth potential in spite of some regulatory brakes. Both the domestic and international flight sectors present huge opportunities. If you take a typical short three-hour domestic flight from Guangzhou to Beijing for example, you may end up sitting in a Boeing 777 or an Airbus A380 with a full three-class cabin configuration and all flights are usually full. If you go to even some of the airports in the second-tier cities in China, such as Xi’an or Hangzhou, they make London’s Heathrow Airport look like a tiny regional airport. The key question here is why is it that some European countries are under-served to China by their home carriers, in particular Spain, Italy and the UK? It is not an easy market to serve and yields remain low, but it is a must-do market. In 2013, British Airways excitingly opened the London Heathrow to Chengdu non-stop route, operating using a Boeing 777 aircraft with its nose painted as a panda’s face and traditional Chinese calligraphy on the fuselage. Much song and dance was made of the flight route, with even celebs endorsing the route. But less than three years later, the national flag carrier dropped the route because it is not commercially viable as there was not enough interest and flights were running below capacity. Even after having trimmed down the frequency and switched to a smaller, Boeing 787 plane, BA ended the service in January 2017. The airline has meanwhile increased its Shanghai frequency from six times weekly to daily and the airline, as well as other British airlines, look very under-represented in this large and fast-growing market. In spite of Finnair carving out a successful niche, Oneworld is an also-ran on Europe-China, with only a 10% share. But it is not just its current size that makes it attractive to foreign carriers, it is its potential. I also believe that tourism agencies in the UK need to do more to sell China as a good destination for visitors from the UK. While Chinese tourists to the UK are at a all-time high; however, even with a slew of iconic sights, Britain has still lagged behind other European destinations due in large part to unfavourable visa policies. However, the post-Brexit weakening of the pound has given the UK a major boost in mainland Chinese arrivals. Chinese tourists are some of the UK’s highest spenders, staying longer and travelling more than visitors from other countries. But the trend needs to go the other way around as well- except for Hong Kong, mainland China is not sold as a premium destination by British tour operators and airlines. From what I see, and I stand to correction from anyone, but the vast majority of the people who travel to Hong Kong and mainland China from the UK are students going back home for holidays, the Chinese Diaspora returning back to their ancestral homeland or business people. Hong Kong has traditionally been sold by British tour operators because it of its lure of being a great stop-over city for those going to Australia and New Zealand and for being a business hub. I am surprised that Hainan Airlines has not been selling Sanya, China’s version of Hawaii, as an exciting winter destination for Brits to visit. Even Thomas Cook Airline, which is known for taking people to exotic places, is losing out on this goldmine of a market. According to a recent figures released by VisitBritain, tourism spend by Chinese travellers is also up in a big way, stripping past the decreased value of the British pound. Compared to the first quarters of 2016, tourism spend was up over 54 percent in 2017. It’s worth noting that with the growth of Chinese travellers to Britain, the country still lags well behind other European destinations. Britain’s best year for Chinese travel, 2015, saw 270,000 Chinese arrivals. In contrast, France saw over 2 million Chinese tourists in 2015. Even a small country such as the Czech Republic surpasses Britain in terms of tourism numbers. 285,000 Chinese tourists travelled to the Czech Republic in 2015, and 355,000 visited in 2016. So, it would be interesting to see which routes will be operated on these open skies between China and the UK and I do hope that Britain becomes a leader and not carry on playing catch-up with the rest of the world in this thriving market. This article first appeared in the Huffington Post Blog and also on China Plus. Opinion article on China Plus News: The Financial Research Industry Must Adapt to Disruption12/18/2017

With the Chinese Premier Li Keqiang meeting with the British Chancellor of the Exchequer Philip Hammond earlier this week in Beijing, and calling on the two sides to make use of London's advantage as a global financial centre to enhance financial cooperation, it is vitally important for British and Chinese companies, especially those in the financial research industry (such as Third Bridge) to adapt to digital disruption. I take a look at the reasons why.

中国国务院总理李克强本周早些时候在北京会见英国财政大臣哈蒙德,呼吁双方利用伦敦作为全球金融中心的优势加强金融合作,这对于中英企业,尤其是金融研究行业(如高临)适应数字化颠覆至关重要。我来剖析其中的原因。 I have also published a slightly modified version on my LinkedIn account. |

Get in Touch:LIFE MATTERSHere I share my thoughts

and experiences during my travels, and how some things have affected my life as an expat and world traveller. Travelling is about capturing that moment in life. Every word, view and opinion on this page is that of Navjot Singh - except where indicated. The most recent is at the top. Scroll down to read the archive. Or search using CTRL+F (COMMAND + F) and enter a keyword to search the page. Just some of the stories you never heard before. The NAVJOT-SINGH.COM web blog is separate to this web site....Click blog, which may not be visible in some countries due to local firewall restrictions, so in those cases this weblog may be read. The weblog also includes some of my press trip reports- most of which are not published on the official blog because of copyright issues. The weblog also contains articles that may be associated directly with a PR trip for a country, airline or a hotel. These are PR reviews done in relations with various companies. If you are an investor or a trend watcher then you may find this website useful as investing has a lot to do with personal observations and finding the ideal trend or next big thing. The average human on the street frequently knows far more about the state of the economy than politicians, university professors, subject matter experts, and financial analysts who seldom travel, or if they do so, only from one hotel to another hotel! The pulse and vibrancy of an economy is nowhere more visible than on a country's streets. All photos and words are © Navjot Singh unless stated. Photos taken by others or by agencies are appropriately copyrighted under the respective name. No photo or word/s may be taken without the prior written permission by the author (i.e. Navjot Singh). All Rights Reserved. Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed